2:00 Assessment of the global economy and capital markets

- So much stimulus money went into the system in 2020 and 2021 that it strung out for a while. We would normally be in a recession by now.

- Greenspud: Many of the Wealthion/TM guests have used this excuse for why their initial recession call timings were incorrect. They never present any evidence to show that definitively as the reason. Exactly how is this stimulus money stlil circulating? Are there government infrastructure projects that were delayed? Did individual consumers get that rich using their hundreds of dollars in stimmy checks to trade $GME and Bitcoin? 😆

4:30 AT mentions recent David Rosenburg interview, where it was said consumers have dropped their savings rate and shifted to credit to spend, which could fuel the continued bubble.

- Ted Oakley agrees (of course), adds that on the banking side people are getting home equity loans. (Note to self: need to find charts to visualize this 🎗️)

7:30 will 2024 be more painful for investors?

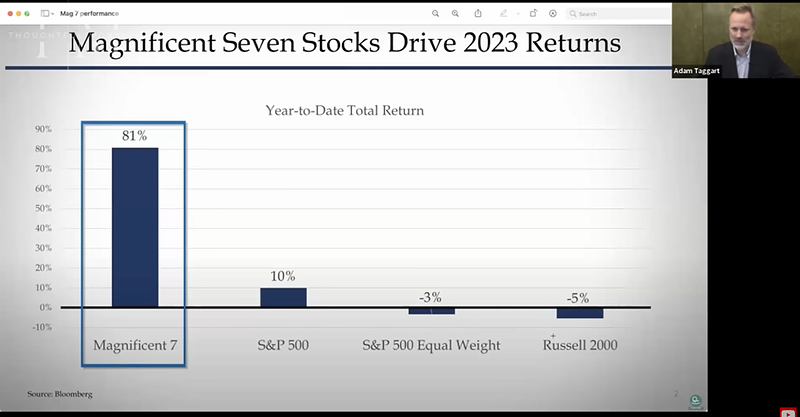

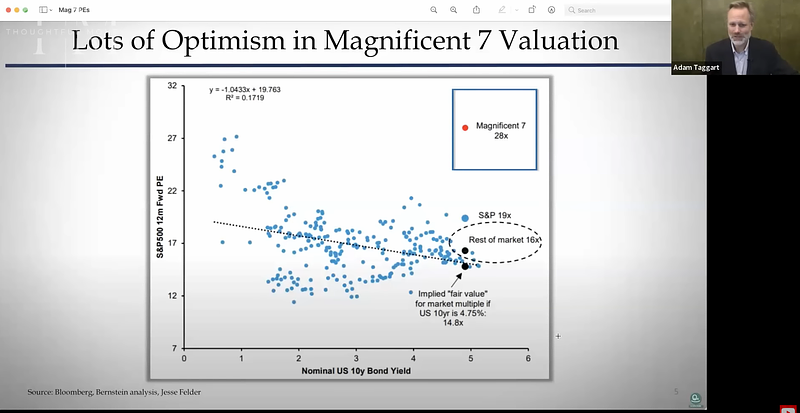

- AT: cites Rosenberg, Fred Hickey - believes "magnificent 7" will reverse. Tom McClellan sees poor technicals (2024 the year the wheels come off)

- Oakley: Bear market began in 2022, thinks it be much like 2003. Worst part of the bear market is the very end which has dramatic sell off. The "generals" get taken out. Thinks next 2 quarters will be rough. Originally thought Q4 2023 would be weak. Believes Q4 GDP will be weak, Q1 and Q2 of 2024 to have real trouble.

- AT: Darius Dale shows that stocks perform really well right up into the recession, and "party gets crazy just before the cops show up". Party seems to be going strong at least in tech.

- AT: Will the "generals" get shot (magnificent 7) with the infantry men? (Note to self - who were the generals in 2000, 2008, and maybe look at 2020 too? 🎗️)

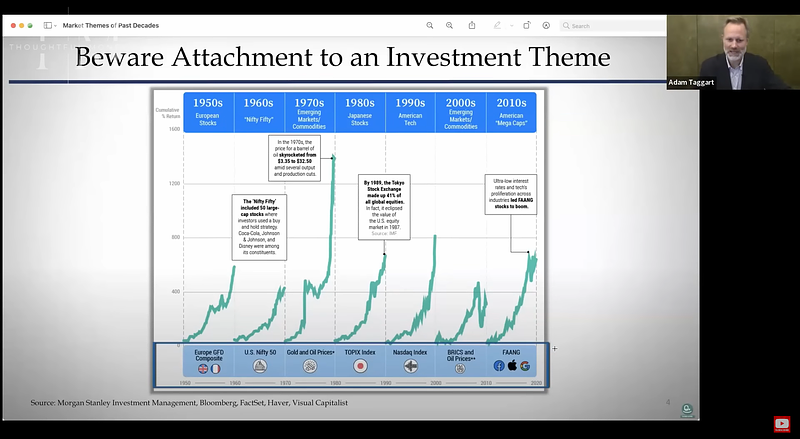

- Oakley: If you take tech, it's at the highest percentage of the S&P500 than at any time before. In the 2000s it was Internet stocks.

- AT: We are about 15 years into the current tech cycle.

- Oakley: in 1989 they took criticism for not owning Japanese stocks, but they were very high multiple at the time. In the 90s (95-2000), Nasdaq, "same sort of thing."

- You'll have 15-20 year periods for finance followed by 12-15 year periods for commodities. Commodities haven't been in play for so long that people have forgotten about them.

- A lot of things could change this decade [the 2020s] because we're so overpriced. It could be up and down like the 70s, not go anywhere because we were so overpriced.

- AT: David Rosenberg, Adam noted similarities in the discussion. Oakley mentioned using Rosenberg's research.

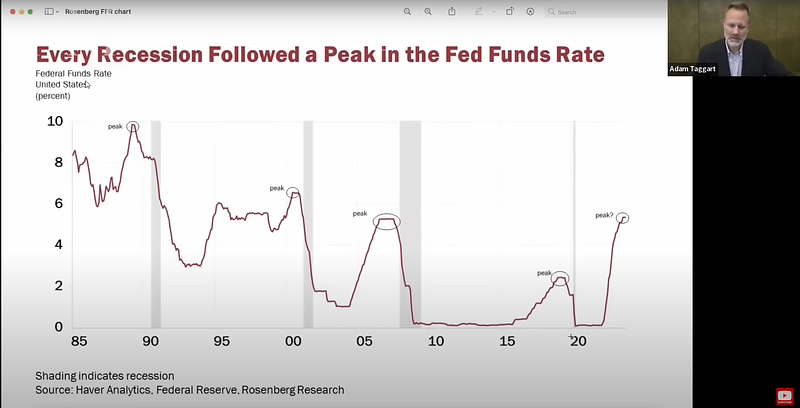

- AT: History shows that 5 months with no rate hike means the rate hike cycle is over. Recession tends to follow immediately after the first rate cut. If history is to repeat, there should be a recession in the coming year.

- Oakley: in 2008 what broke the market was 5% interest rate level. Today we are in the same place except with more debt.

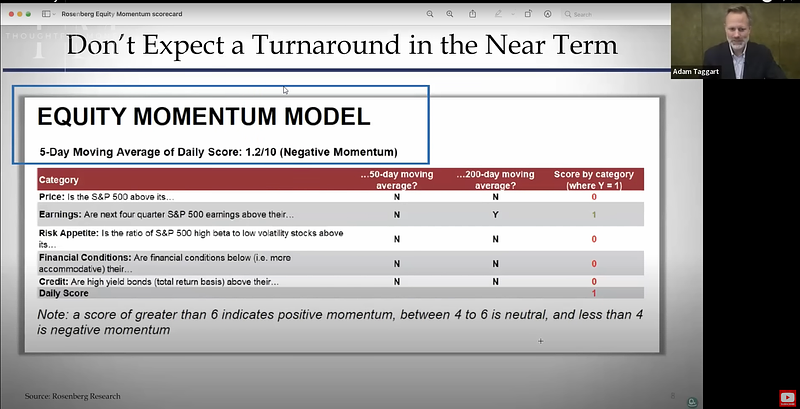

- Rosenberg Equity Momentum Model. Anything above 6 indicates positive momentum. Indicator is currently at 1.2.

- Oakley: 4400 level on the S&P may trigger a lot of "stuff" for technicals reasons. On the earnings themselves, companies play a game of making numbers easy to beat. As an indicator, the guidance is more important. Are they guiding down? Yes. Triple C defaults going higher? Yes. Look at all of those things and put them together.

- Worst of the problems are probably in private credit - i.e mezzanine financing rates right now. 14 or 15 "points" (did he mean percent?) high right now.

21:00 AT: Will we see an early warning to the economic carnage?

- Probably not. It will be like the commercial real estate. They will go to investors and give options like a "cash call". When you see that sort of thing is when you know you're in trouble. That's what youll see in private equity. There are probably way too many 30 year olds in private equity who don't know what bad times look like.

- If you've been in the industry 30 years "or longer" (did he mean to say "or less"?) you haven't even seen rates go higher.

- Warren Buffet - he sold things during this Q, has $157B in cash on the books, and about 78-80% of the portfolio in 5 or 6 companies. That tells me he doesn't have anything to buy or already bought it.

- In 08 or 09 they were doing a lot of billion dollar investments, that's how they make big money, but not right now.

- AT: Buffet owns a lot of $AAPL. That's one of the generals that may get taken out. Fred Hickey is very pessimistic $AAPL and $TSLA. $AAPL has had 4 or 5 quarters of revenue contraction. Why would Buffett be holding onto a company that is unable to grow revenue?

- Oakley: Buffett may be influenced by some of the lieutenants "if had to guess". Doesn't know him personally. When you get a $3T company, it's really hard to move the needle. No Steve Jobs, they don't have big major innovative changes. What are they going to do? Invent a new iPhone?

- It used to be Sony in 1996. Everyone had Sony and said "there will never be another Sony". Like so many things, that statement was not true.

26:00 AT: What might be the next big sector for the next cycle after tech fades?

- Oakley: Commodities - because we shrunk supplies of all of these things. Commodities are in short supply, not saying it will happen but it could happen.

- As far as new tech - may not be AI because it's sort of like the Internet in the late 90s. The real "club" for AI is probably very small but at this time we don't know who yet.

Greenspud: I'm bullish commodities, but I don't see them being the major leader in the way the "Mag 7" are right now because when companies start increasing mining and commodity generation activity, it decreases the price and margins for them. Just like the oil glut that came about from the fracking revolution. Oil companies made big money for a while but it was quickly over due to the overinvestment leading to massive supply influx.

The "tech" everyone is talking about is a 2023 theme. Did anyone think tech was great in Q3 2022? No. It just took off this year because of the hype around ChatGPT.

I don't know what the next thing will be - it might even be war related stocks because of all the geopolitical tensions. Governments will be investing in new weaponry. I think $PLTR is at the leading edge of this theme.

28:00 Debt & Bonds - cited concern about overall level of debt and corporate debt maturity wall. Debt will have to be refinanced at much higher rates.

The "tech" everyone is talking about is a 2023 theme. Did anyone think tech was great in Q3 2022? No. It just took off this year because of the hype around ChatGPT.

I don't know what the next thing will be - it might even be war related stocks because of all the geopolitical tensions. Governments will be investing in new weaponry. I think $PLTR is at the leading edge of this theme.

28:00 Debt & Bonds - cited concern about overall level of debt and corporate debt maturity wall. Debt will have to be refinanced at much higher rates.

- 47% of the US debt comes due in 2024 and 2025, which will be refinanced at almost double cost. Thinks Yellen should be chastised for not booking longer duration debt when rates were low.

- Corporations loaded up on the lowest cost debt they could find when rates were low. We didn't do that on the government level.

Greenspud: Oakley shares the same complaint as Stanley Druckenmiller about Yellen not refinancing the government debt at longer durations when we had better rates. However, George Gammon has an alternative take on this.

When you view the US dollar and Treasuries as systemic banking infrastructure, Yellen issued our debt on the shorter duration because the T-bills are needed as collateral within the banking system and at times there aren't enough T-bills to go around. Without them, the banking system goes bust. So, she had no choice but shorter duration!

33:00 lag effect

When you view the US dollar and Treasuries as systemic banking infrastructure, Yellen issued our debt on the shorter duration because the T-bills are needed as collateral within the banking system and at times there aren't enough T-bills to go around. Without them, the banking system goes bust. So, she had no choice but shorter duration!

33:00 lag effect

- The end of it is the worst damage. Investors have regrets about not acting sooner. The lag effect this time will be bigger because of more money in the system, asset prices are higher so people feel better about their home value, etc. The lag effect with catch a lot by surprise, especially older people. (Yeah, no different from 2008)

35:30 AT: Asks whether Oakley thinks now is a good time to be holding long duration bonds.

- Oakley: rates always roll over. The only Fed president he believed is Volker. He thinks once there is pain of any sort in the economy, Fed will flip immediately and won't even care about the consequences or 2% inflation. Election influence too.

- Doesn't think the 2% inflation target is going to work.

- If you don't have inflation, it will break the government. The inflation is needed to shrink the real size of the US government debt.

Greenspud: A long time ago I read John Mauldin's book Endgame and there he talks about how the government inflated away its World War 2 debt in the late 40s and early 50s. After reading that book I always knew massive inflation would be part of the equation to bringing the US back to solvency. It's terrible for average folks whose paychecks erode away in the short term, but it's by design. Maybe that makes a case for owning real assets.

38:00 Inflation and debt servicing

- Oakley: cites the 30 year inflation cycle that began in 1946 and culminated in the 70s.

- This time it may be a situation where you need to be balanced (short paper, less than 60 months) so that you can wait this out. You can't wait out 20 or 30 year paper.

- If you bought a long term bond in 2021, you're down like 45% now and need to make 100% to get back to breakeven. That's tough.

- AT: 2023 will be a third consecutive down year for US Treasuries. Oakely: odds are slim that 2024 will be a fourth year of beearish US Treasuries.

- In January he starts to think "what could happen or change this year?" Greenspud: this makes sense why the stock market has seasonal performance trends on the calendar. I could do a whole separate post about that.

- Foreign buyers of Treasuries has been declining. Back in WW2 you had to buy the bonds (you couldn't own the gold [because it was banned]). There's all kinds of things the Fed could do [presumably to make people buy bonds?]

45:25 AT: What is your main themes in portfolio positioning right now?

- Stocks - they are in the market. Just because they are 45% liquid in the stock account, doesn't mean they aren't in stocks. They've cut back on some legacy positions like $AAPL $MSFT and bought some consumer staples. If they can get 2/3 of the S&P return with only 55-60% liquid "we win".

- On the very conservative side, only 3 strategies. 65% short duration treasury. 10-20% long term (20-30 year duration). What's offset the long duration is doing well on the short end. Getting some great tax free bonds, better net return than the short term treasuries.

- High income group - anything that had "income" at the end of the name got hurt this year - Preferred stock, REITs, only gas MLPs did well this year. They got stopped out of some REITs.

- Starting to see some really good companies with high dividends right now. Greenspud: I agree, I'm looking at those too!

- People will see that December 2021 ended at the high and they had a great year. Next year, he thinks a lot of those people may look at their performance since December 2021 and realize they haven't made any money or are down 30-40% and will throw in the towel and give up. The worst comes at the end. "That last 25% of a bear market is where they get everybody."

- They had a lot of cash in 08 (like 45%). DJIA went from 14,700 in October of 07, by December was about 8800. They put in half their cash. DJIA by February of 09, it was 6500 (another 25%). They put in more money. They only had 3% cash left at that point. They were early to buying, but the stocks were cheap. If you looked at those buys over the next period, they were really good buys. Thats what makes you a lot of money.

55:30 - Personal wisdom

- What are the biggest obstacles that get in the way of high net worth clients? Happiness comes internally. "I have people with only $2 million - they're the happiest people in the world. They're internally happy." (Greenspud: umm... I think the $2 million has a lot to do with it)

Greenspud final thoughts: I agree with Oakley and other guests with similar thoughts about the concerning fundamentals of the economy and stock valuation indicators. However, many of these same arguments were prevalent last year just as the market was near the bottom of its 2022 dip. Listening to interviewees like Oakley who make convincing bear arguments has kept me out of many great opportunities over the past 15 years.

I remember back after 2008 there were many people on TV and in publications telling you why the fundamentals were bad and that it means that stocks are overvalued. There was the Greece debt scare of 2010. Every time Bernanke pulled back on the QE the stock market would throw a fit. 2015 had a scary correction and the recession indicators were flashing once again. Like a gullible retail investor, I was selling at the best time to buy. (Refer to my previous post where Lance Roberts talks about this phenomenon.)

My plan to trade the upcoming uncertainty is to throttle the percentage of my overall portfolio in proportion to how risky I feel about the market at any given time. I haven't been 100% in stocks for the past several years, but I will go in with some percentage in between. Maybe a better way of looking at this is that I ask myself: "How much cash do I want on hand in case the market dips and what will I buy at what prices?" So far that approach to risk management has worked for me in 2023. Now you figure out what works for you.