Before watching this interview, I read Sven's blog post The Cynic's Guide to Markets, where he presents an explanation for why the stock market in 2023 remained so strong despite all the reasons the bear cases made at the end of 2022.

Some interesting facts presented:

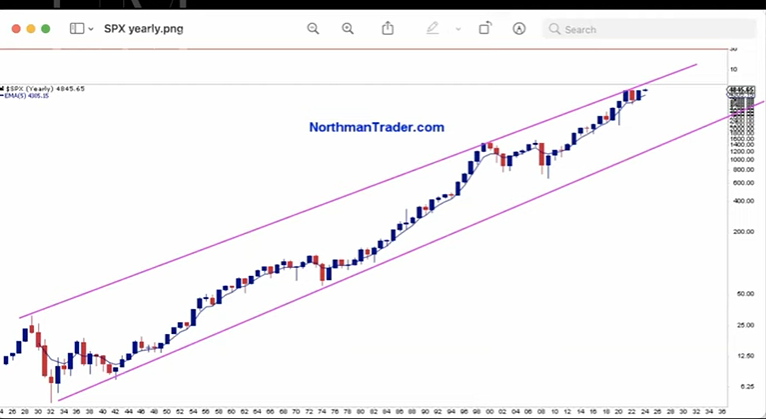

- Since 1932 there were only 3 instances of more than 1 down year in a row - WW2, 70s, and the 2000s dot com crash.

- Whenever the market retreats to the 5 yearly EMA, it's been a strong buy signal

- The stock market is now bigger than the economy. 200% of GDP post Covid after all the interventions.

So basically Sven presents an argument for the stock market having been propped up by intervention of policymakers.

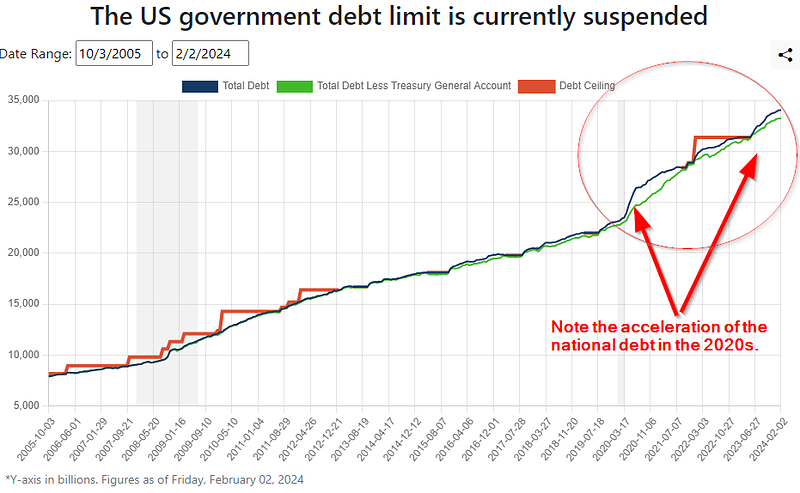

See here’s a potentially really dark takeaway of all this: In the past markets used to be smaller than the economy. But ever since the technology boom of the late 90s and the subsequent age of permanent intervention which prevented any true cleansing of markets save for the brief period of the global financial crisis markets have become ever larger versus the economy.

I guess you can say the stock market is now "too big to fail". Sven's thesis is that every time the market gets close to a collapse, the policymakers will intervene and prop it up (at the long run expense of the Middle Class).

4:30

4:30

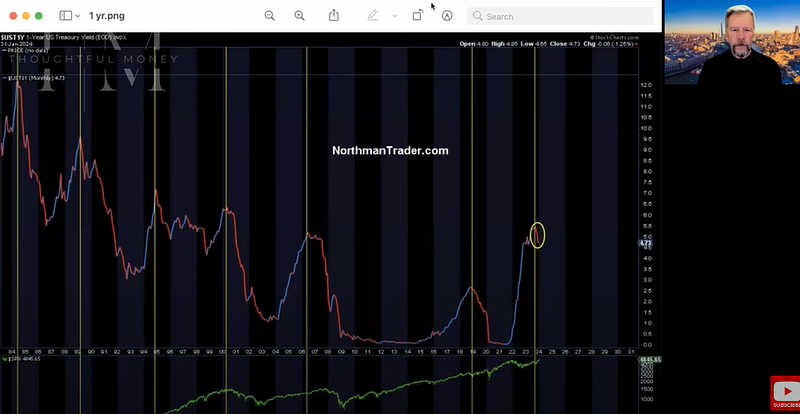

- Last year all the Fed speakers were saying "higher for longer", but then October Yellen made a statement contrary to the Fed that higher for longer may not be a given. Went against the grain of Fed positioning, and then a few weeks later we got a reversal in yields. Major relief rally from the peak tightening. This is a cycle that repeats.

7:00

- Last year we had the largest non-recessionary fiscal deficit in history. It's not until the labor market cracks that something bad happens.

- Who's doing the hiring now? Half the jobs in the last couple of years have come from government hiring. Civilian labor force is shrinking.

- 9:30 - is the fiscal stimulus so strong that it will override any lag effect of interest rate hikes?

10:20

- Layoffs from private industry rolling in in the tens of thousands. Companies have benefited from all the inflation because it was a great way to pass on costs to consumers. It boosted profit margins. Now with inflation coming down they have to lay off employees to maintain the profit margins.

- These layoffs can go on for months without cracking the economy. It's not systemic yet. When it does become systemic is when it will affect retail spending.

11:50

- Deficits, can keep on rolling. Atlanta Fed just came out with a GDP expectation revision from 3% to 4.2%.

13:25 Adam states the historical precedent that when yields peak (i.e. just before the Fed pivots and start cutting) is typically when we enter a recession.

- Sven says there are two phases: yield relief when the market parties. But then the second phase is when dropping yields are no longer reflecting the relief part but are reflecting an economy slowing down dramatically. That's the typical lag effect part of it. So yield relief turns into yield terror, and that's when yield curves uninvert back to positive. The big ones haven't uninverted yet, so yield relief still exists.

19:00

- In 2018 Yellen said that $20T debt should keep everyone awake at night. Said that the deficits are unsustainable.

- Now we are way past that level the rhetoric is the same and nothing is broken. There is no way out now.

- Yellen has a need to see lower interest rates and lower interest rates coming fast because the interest costs are going to constrain them. Between higher for longer vs not higher for longer debate - who is in charge? (between Powell vs Yellen) Sven hints that Yellen is stronger in this battle.

- Reverse Repo vs funding requirements. Yellen was willing to take on higher interest payments in order to avoid going through reverse repo. Basically Yellen helped fuel liquidity into the markets, which loosened financial conditions going into the December Fed meeting. Powell doubled down on loosening financial conditions, lighting the rally even further on fire. That made very little sense on paper.

- Pay attention to who is messaging and what they are messaging and when.

Yearly market chart - Despite Covid and all the money printing nothing is broken in the market. Covid crash was a little dip. (This is what he talks about a lot in the blog post. Government is there to bail out the market every time we get close to a crash.)

32:30 2024 could be a bumpy ride, but if we do have any weakness in the economy the government response will be overwhelming and will ignite a very strong market response.

- Based on historical Presidential election year performance, we can expect intermittent highs with a little chop, and a rally into the end of the year.

- Historically the 5th year of a decade is up, but then you have trouble in the back half of the decade. (~10 year cycles). 1999 end of an up year, followed by a few years of trouble. 2005 an up year, followed by trouble. 2010, 2011 rough years, then up. 2018 was a down cycle. Look at the pinned tweets in the cited blog post for details.

From Sven's blog post:

The most glaring conclusion of all this: Year 5 is up. Every single one of them. Wild. The most consistent history in stock markets. Don’t ask me why, but it is so. Every time. Can one decade at some point be different? I suppose so, but at this point I have zero basis to not expect a repeat.

Year 4? While some are smoothly up, some are not and in fact some can be quite nasty with corrective activity into Q1 and Q2 in particular. But the larger message stands: Whatever weakness there is in year 4 it’ll get bought.

I think this means his model is predicting 2025 to be an up year for the market.

41:00 Michael Howell's projections align with Sven's outlook. We are in an up cycle that has about another 2 years left. Felix Zulauf also believes market will continue to do well even though he's a long term bear.

50:00

50:00

- Mentions the year end performance chasing phenomenon pressuring money managers to buy stocks, even if the act is disconnected from their beliefs about fundamentals.

1:00:00

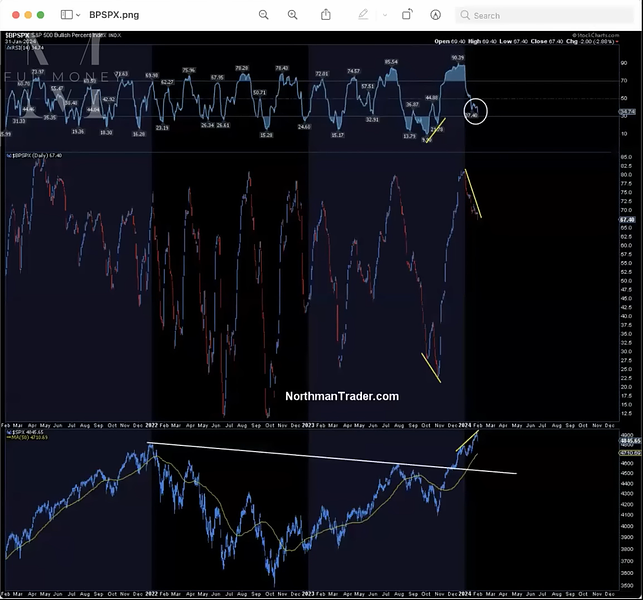

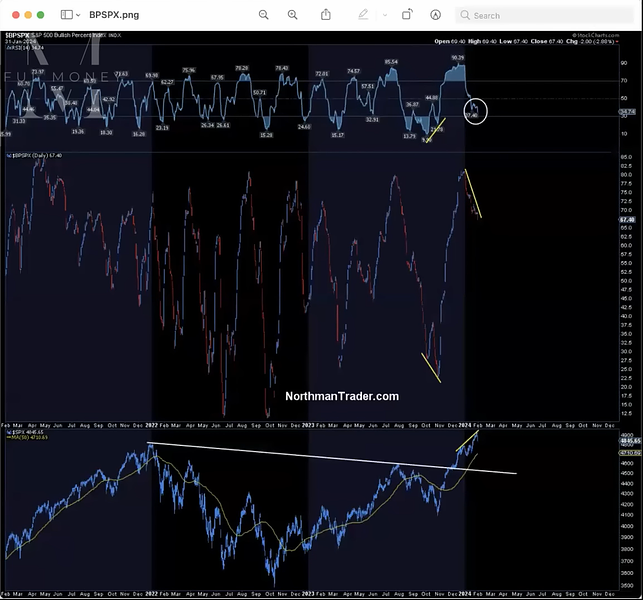

- As a technical trader, he's baffled by S&P500 hitting all new highs every day but RSI is not moving. Hasn't seen that before. May indicate that something is being masked by the few stocks propping up the index.

- $NYSI market rhythm oscillator - showing oversold conditions right now. (odd because it conflicts with SPY action). Only other time he saw oversold conditions like this during market all time highs was right before the Covid crash.

1:05:00

- BTFP gets removed in March. What happens to reverse repo facility? (Suggesting that could lead to the chop you typically see in a Presidental election year - we get a pullback and then the Fed steps in to the rescue, so buy the dip.)

1:08:00

- Based on the technical signals right now he's cautious. Does not have a swing buy signal.

1:09:00

- Cup and handle pattern identified at the start of Q4:23. We got a moment where the market got oversold when the Israel war broke out in October, but it reversed and then he got conviction to be bullish. This was a powerful breakout.

1:14:00

- If big tech stocks got creamed, there would be a quick change in sentiment.

1:18:00

- Psychology - even fools the best traders. When the market is going down it becomes a reinforcing mechanism. Money managers were calling for lower and lower targets in the end of 2022. When the market is going up it's the opposite psychology. Market ignores all bad news and everyone is chasing up.

- All that matters is liquidity and whether conditions tighten or loosen. Janet Yellen controls those conditions. We are in an election year and there is political motivation.

- If things break and we have a breakdown of the 4500 level, then look at the yearly 5EMA at 4300. Show an end of the year close below that and then psychologically it would seem like the end of the world again.

- If we did have a break below the yearly 5EMA, 2025 would be huge rate cut time.

1:25:00

- You cannot let this thing drop in a major way because everything is so heavily invested in it. What influences it more? Does the economy influence markets, or do the markets influence the economy because the markets are so much bigger?

1:30:00

- The Middle class got screwed. Housing is unaffordable, the 1% are getting richer.