1:00 FOMC meeting for the week was more dovish than expected, which took them by surprise.

- Timeline:

- 2 weeks ago, Powell and other Fed speakers stated that they are not thinking about rate cuts.

- Then on Wednesday, (2 days ago), Powell said that they had a discussion about rate cuts. Quarterly economic projections show that the Fed is now expecting 3 rate cuts next year. Not exactly dovish, but certainly not as hawkish as they were before. Lebowitz: What changed?

- Possible answers:

- The Fed is concerned about a banking problem, liquidity issue, maybe something foreign. They may be trying to get ahead of it and not shock the market with rate cuts if it comes earlier.

- Politically motivated - Yellen or Biden may have intervened and complained about the high rates driving deficits. Biden concerned about reelection? Lebowitz: doesn't put too much credence in that idea because unemployment is low and economy is doing well.

- Banks (who own the Federal Reserve) may have complained to Powell, worried about another crisis like what happened in March with Silicon Valley Bank.

- No new data warrants a change in tone. Only thing weaker recently was PPI. Nothing else seems to warrant a change in mindset or tone.

Greenspud: George Gammon put out an interesting theory today. According to the Fed Beige Book, economic activity slowed, unemployment across all districts has ticked higher (this was noted by Danielle DiMartino Booth the other day too). Every time this has happened historically has been preceded by a hard landing recession.

Remember, the Fed's dual mandate is stable prices and low unemployment.

6:00 Lag effect - Fed needs to start cutting back before we get to 2% inflation because of the lag.

Remember, the Fed's dual mandate is stable prices and low unemployment.

6:00 Lag effect - Fed needs to start cutting back before we get to 2% inflation because of the lag.

- NY Fed President John Williams stated today "we aren't really talking about rate cuts right now".

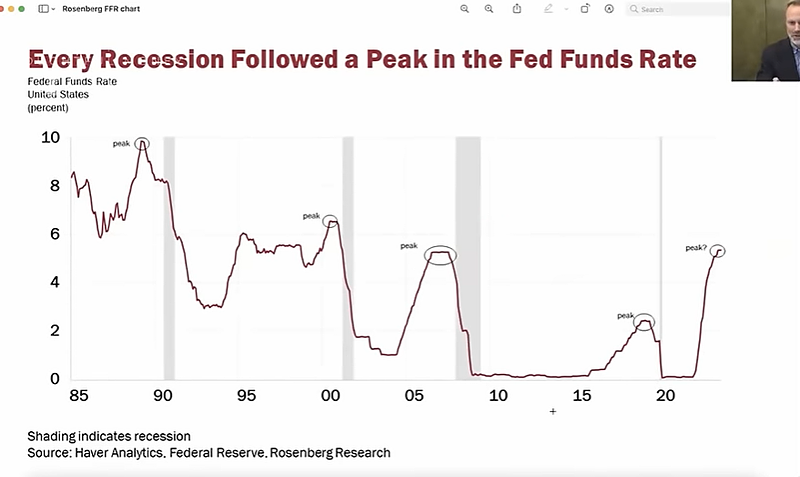

- This is one of the steepest and longest rate hike cycles, so lag effect will be significant when it does take hold.

- Historically, stocks do poorly during the rate cutting cycle, but bonds do well because of rising yields. Bonds fall when the rates plateau.

- 1995 - Goldielocks economy. This is more of a time to plan and be ready, but don't overreact because Fed could still pause and rates might be cut just marginally.

13:54 during the pause, markets still have a lot of momentum. We could see markets go higher and rally? Darius Dale: "The party gets craziest right before the cops show up." Felix Zulauf agrees that markets can go higher in Q1. If we get a pause, how do we use it to plan?

- Could be Q2, Q3, or maybe 2025 before rate cut cycle happens. Economy might still keep going. Unemployment upticked a little but there's nothing concerning. AT: Unemployment is fine until it isn't. When it spikes it suddenly spikes you can't see it coming.

- Liquidity: Fed has been raising rates slowing for a couple of years, then in July 2019 they started cutting. What was happening? Liquidity problems with hedge funds. Hedge funds couldn't borrow money with their collateral.

Greenspud: Heresey Financial does an excellent job explaining the liquidity crisis of 2019 in this video here.

- 19:00 Fed actually targets the "Fed Funds Rate" in a range, which is the rate that banks loan each other money overnight. They intervene in that market.

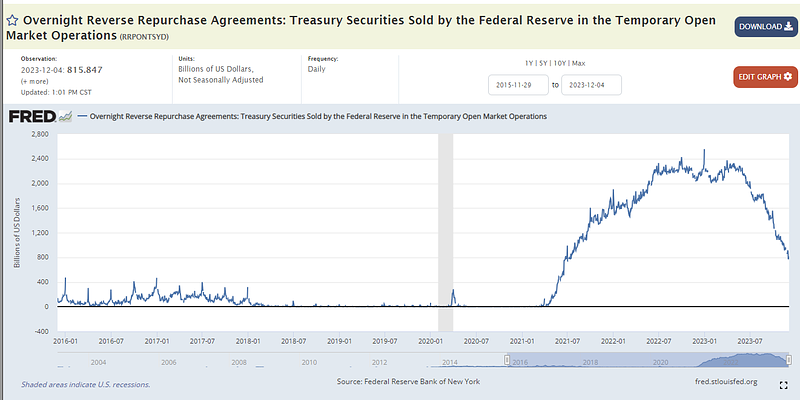

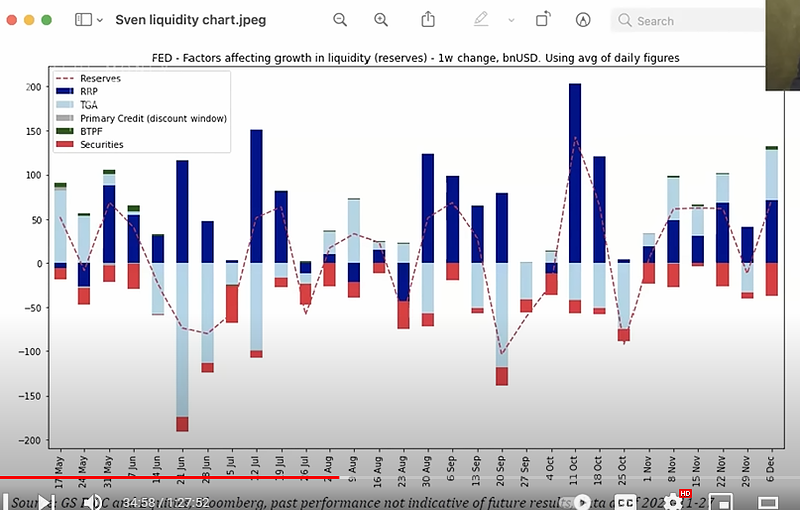

- In 2020, 2021, there was excess liquidity. That excess liquidity got lent to the fed through the overnight reverse repurchase program (ON RRP). Got up to $2.2T. That's excess liquidity - not going to Treasury bills or fed funds. Without RRP, Fed wouldn't be able to control short term interest rates.

- Reverse repo facility use is declining because Treasury bill yields have gone above the RRP yields.

- Fed has always done QE through SOMA account. They would buy and sell 10-Y Treasuries all the time, but it was never a coordinated effort. Previously it was just to manage liquidity in the system.

- Drainage of RRP facility means that excess liquidity in the system is leaving. When it all goes away, there could be stress in the banking system. That may be what the Fed is concerned about.

- BTFP ends in March - another stress on the banking system. Fed may not want to renew it. It's popular among the banks, but not Congress. If interest rates stay at current levels, banks will pay back their BTFP loans and receive back impaired assets. For example, an auto loan held might be worth 50 cents on the dollar at current interest rates, after a few rate cuts that loan might be valued at 80 cents on the dollar, so it will be less impaired and be worth more as collateral in the banking system.

- Without BTFP, dominoes would have kept falling. All the banks have exposure to each other. For example, if a bank in Iowa fails, then loans that JP Morgan made to that bank would get hit too. This happened in the Great Depression. You have to stop problems at the source.

- Many offsetting derivatives in the system. Offsetting derivative trades might have a neutral exposure in normal times, but in a liquidity crisis the values could greatly diverge. This is what happened to Long Term Capital Management. These positions are not ever perfectly netted out.

- 31:30 If the Fed talks about what it's going to do in advance, it's less of a shock in the system. If they unexpectedly cut rates last week it would have spooked the markets. Fed is good about warning the markets ahead of time before they change tactics.

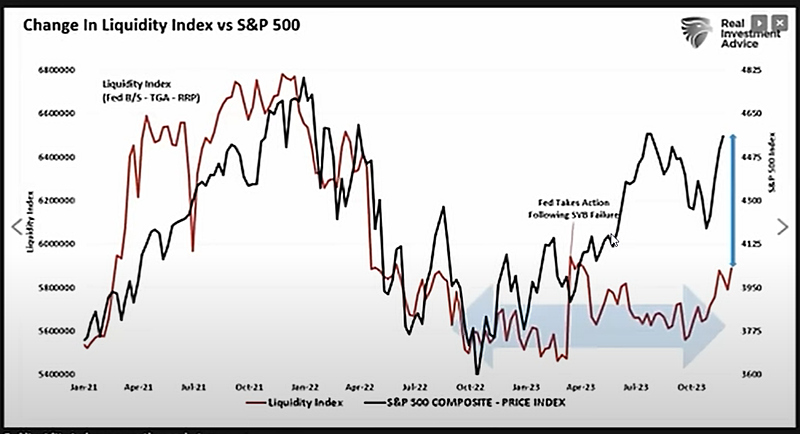

33:00 liquidity - market prices so correlated with liquidity maybe liquidity is all that matters when it comes to predicting market direction. Sven Heinrich - he is looking at the market from a technical analysis side and questioning the same thing.

- There's a liquidity draw coming down the pipe. How much excess liquidity from the last few years still exists? We don't know, we just know it is going down and will go away.

35:00 Danielle DiMartino Booth - once the excess liquidity goes negative than we will feel the effects of QT

- Fed may see the potential day of reckoning coming and trying to get ahead of it.

38:50 - Is the mandate of the system now to always have net liquidity? Maybe the system requires net positive excess liqudity?

- We have become way too dependent on debt and the Fed is micromanager of the economy. If you can control interest rates and liquidity in a debt driven economy, you control the economy.

- 40:00 Lebowitz compares the Fed's maneuvers to a pilot landing a plane. They are adjusting all the instrumentation to try to get a soft landing. Calls this "dangerous". Maybe they pulled it off in 1995.

- The data sets are very hard to use because of lags in the data. The inputs to CPI are questionable.

45:35 - This week's developments - impact on bond outlook? Now that bond yields are coming down, $6T into money market funds. Will that money begin to leave trying to find better yield?

- Not really a concern, because the money mainly went from banks to MM funds. Fed might be concerned that the money won't flow back to the banks where they can be used to make loans.

- The cash on the sidelines thing is "kinda bunk" because if you take your money out of a MM fund and buy IBM stock, the person you bought it from has cash and it goes right back to a MM fund.

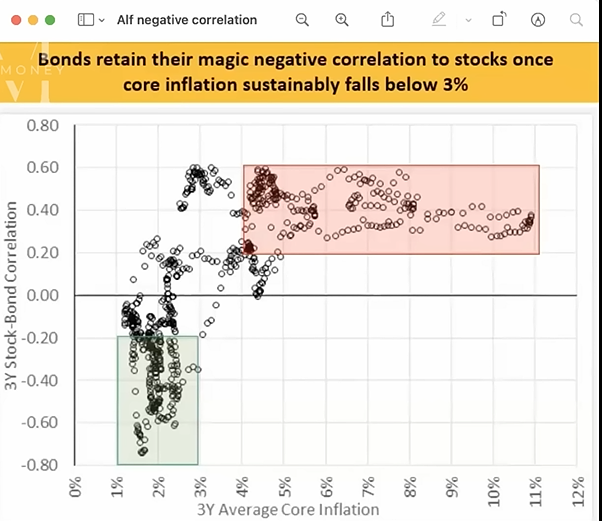

51:00 Alf: when inflation gets above 4%, bonds start losing their negative correlation with stocks and become less attractive to institutions. Believes that this will drive influx of buying into the bond market.

- Lebowitz agrees. Most people don't own enough bonds. They were 2% or lower for a long time. All of a sudden you can get 4-5% on a bond, and stock returns average 6-7%. Bonds look more attractive and you can lock in rates.

- If inflation goes down, bond yields will also go down, and prices go up. Lock in 30-year treasuries at a high interest rate and that could save the pension funds.

Greenspud: I think something being missed here is that there's still the possibility that inflation will get out of control again as the government is incentivized to use it as a tool to fix its debt problem. What if bond yields go up to 8%? Lebowitz just talked about "saving" the pensions by buying the bonds but if there was a huge spike in inflation it would be a disaster.

- Big influx of bond buyers. Current bond rally shows that the world does not own enough bonds.

- Bonds a little overdone right now on technical indicators. Possible pullback coming.

1:00:00 Assuming there's no recession next year, where could rates go?

- Goldielocks scenario - inflation ~2.5%. GDP at ~2.5% also. Economy going ok, no liquidity issues. Rates could be 3.5%. If Fed cuts too soon and inflation spikes, yields can go back up again. If the Fed cuts because of a banking problem, yields could go to 0%.

1:02:00 Yields have been high for a long time. Lag effect. What's your expectation?

- Somewhere between Goldilocks and bearish. We could be in this nice area for a while. Maybe 3-9 months. Be careful betting against market.

- Technicals helpful when there is uncertainty.

- Stocks are very overbought right now.

1:06:00 Trades

- Bought $FANG energy stock. Likes crude oil. Greenspud: I agree, I added $CVX.

- Oil is an inflation hedge too. Gold, Oil, TIPS best hedges against inflation.

- For now, inflation is under control.

- Ideal time to buy TIPS is when inflation is very low.

1:09:00 Zulauf: likely path is that the slowdown gets ahead of the Fed and then they have to go to full rescue mode. Rest of the world does the same. We get a ton of inflation.

- 2021 inflation was caused by supply side shock shutdown because of Covid. That's a huge factor. If it was just the supply side and not monetary, then if the Fed hits the gas it may not be nearly as inflationary as people think it will be. I'm glad he mentioned this. not too many analysts talk about the supply constraint aspect of the inflation.

- Biggest fear - government wlil keep expanding on stimulus to households now that they've done it during the pandemic.

1:13:00 Nonmonetary investment

- Put your phone away, especially off of work. Exercise. Don't get caught in ruts, be social....