2:25 assessment of the economy/markets

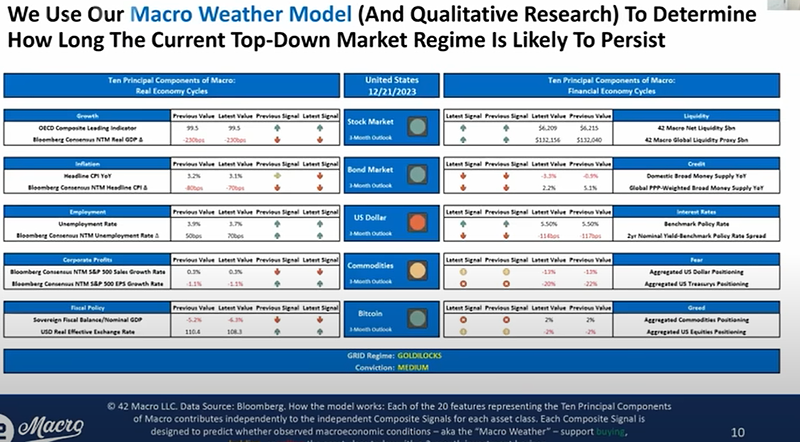

- We are in a "goldilocks top down market regime" (growth accelerating, inflation decelerating), their propriety quantitative tools say. Supported by a rising probability of a soft landing of the US economy.

- Their firm wrote about the strong economy in 2022, which is why many investors were wrong in 2023. If we have resiliency persist and positive inflation outcomes, monetary easing in financial markets wlil promote the business cycle moving forward.

- Fiscal impulse - very positive throughout 2023. Very unlikely we see a fiscal cliff heading into an election year, especially with an incumbent Democrat president. "As bullish as I can posisbly be"

- All Positive signals in their models (their "Macro Weather Model"):

- Bullish 3 month outlook for the stock market

- Bullish 3 month outlook for bond market

- Bullish 3 month outlook for the crypto market

- Bearish 3 month outlook for the USD

- Greenspud: Something confusing to me about this is that their models factor in the 3 month outlook for the stock market to determine how to invest in the stock market. Seems self referential to me.

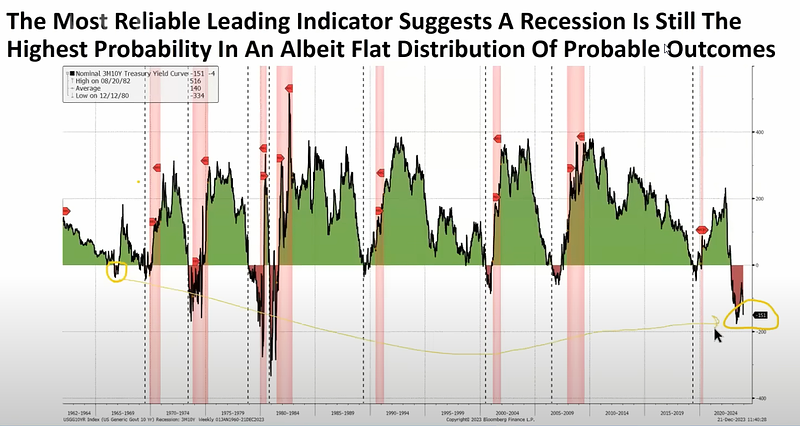

5:45 Referring to his last interview where he said that their indicators were looking positive. Stocks look their best right before the recession. (i.e. the "party gets craziest just before the police show up.)

- Recession is not their modal outcome assumption, never was. Their yield curve analysis previously said that the likelihood of a recession happening, if it was going to happen, would have been between Q4:23 and Q2:24. We needed to be on high alert for the rising probability of a hard landing.

- The probability of a hard landing is now diminished.

9:25 Is rising liquidity a factor in their analysis?

- Liquidity rising domestically and globally since October 2023.

- Things that lead the liquidity cycle: USD, bond market volatility, currency volatility, crude oil - all those things are suggesting positive liquidity movement for the near term.

- Spends the next part of the interview going in depth on the Macro Weather Model inputs.

22:20

- The market may be overvalued, but it may get more overvalued as investor positioning gets forced into this goldilocks trade. Money managers will get fired if they don't chase performance. Retail investors expected to chase performance too.

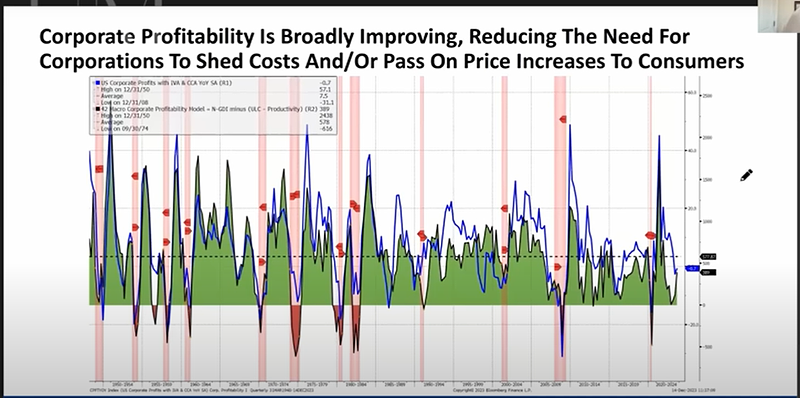

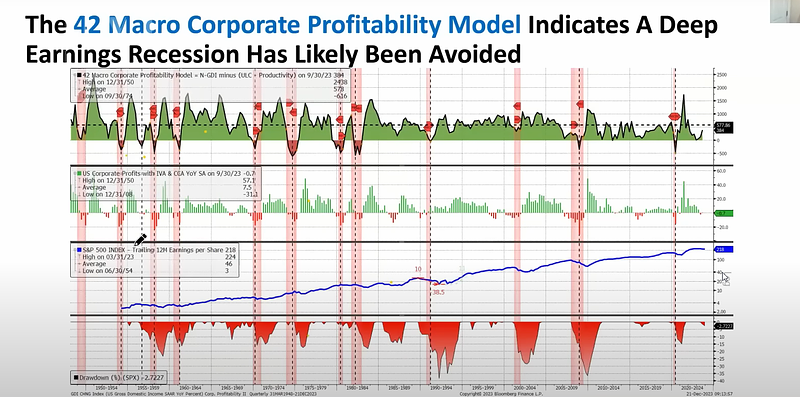

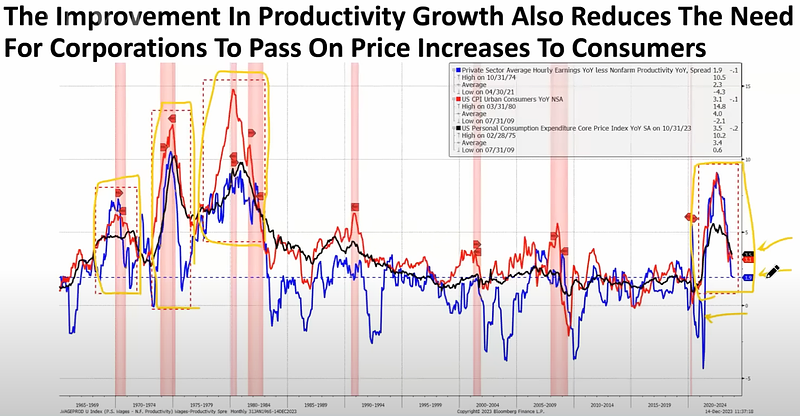

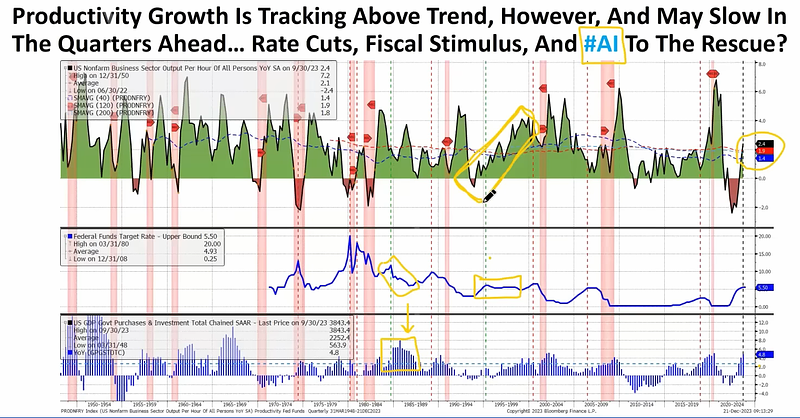

- Important to acknowledged that things have changed. Increased likelihood of soft landing. The most significant reason driving this is a material bounce in productivity growth. This causes corporate profitability to improve.

- Greenspud: I wonder if the reason for increase in productivity was caused by all the layoffs that happened in 2023. Many companies got leaner and more efficient.

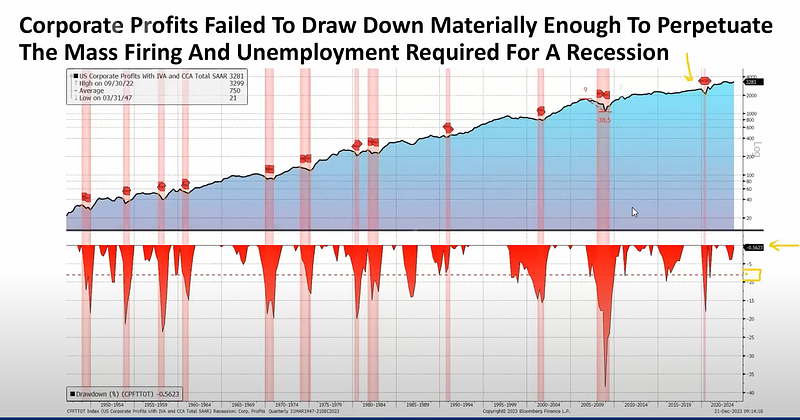

- Corporate profitability models show improvement, so we are unlikely to see an earnings recession.

- Mass firings become a self-perpetuating process that spirals down the economy. We've avoided that according to these models.

- When you have a big spike between wages that causes a divergence from productivity, you get inflation. Happened in the 70s and post Covid. Now that Covid is over productivity and wages have come back into a more normal spread.

- Soft landings are rare. Of the last 9 tightening cycles, we've only had 2 soft landings. In the mid 80s, and in the mid 90s. All other instances led to hard landing in 18-24 months.

- How to create a soft landing:

- Positive trend of productivity growth

- Fed needs to acknowledge that the policy is too tight and pivots

- Above trend growth in government consumption and investment

- Next section of the interview was about their portfolio construction strategy KISS - Keep It Simple & Systematic. Their firm is max invested.

- 42 Macro investment thought process is not so much to look at fundamentals and take a position, but to look at the overall market regime and position based on what kind of market environment we're in.

42:00 Interest rates

- Swaps are pricing in 7 rate cuts over the next year. Darius considers that to be aggressive and unlikely. The money markets are priced to perfection.

- Greenspud: This is why I take an interest in what Darius has to say, but I'm not going to allow it to affect my investment decisions too much. Because so much optimism is priced in, I think the market psychology could flip very suddenly. All it will take is a hot inflation number and for the Fed to shift back to a more hawkish stance that sends the market into a severe correction. If that occurs his models may catch onto it quickly, but we won't be hearing about it soon enough to adapt to the change.

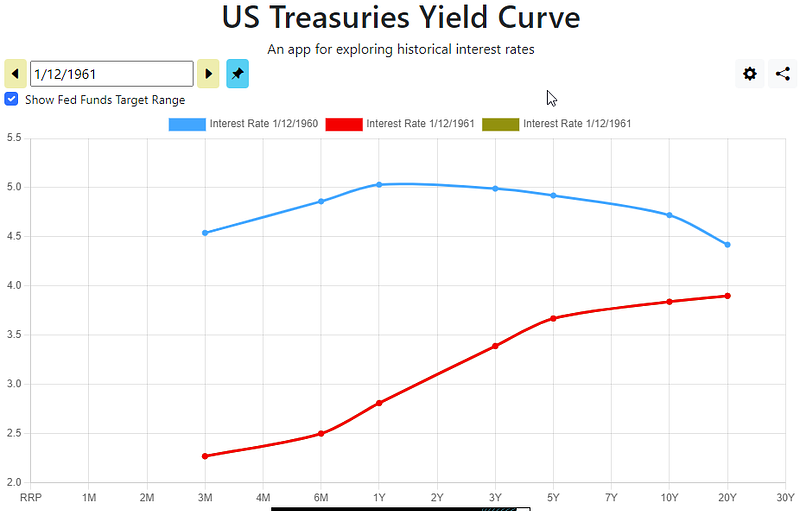

- The only yield curve inversion that did not precede a recession was the one in the 1960s.

1960s yield curve inversion https://www.ustreasuryyieldcurve.com/b/1MQ7ax

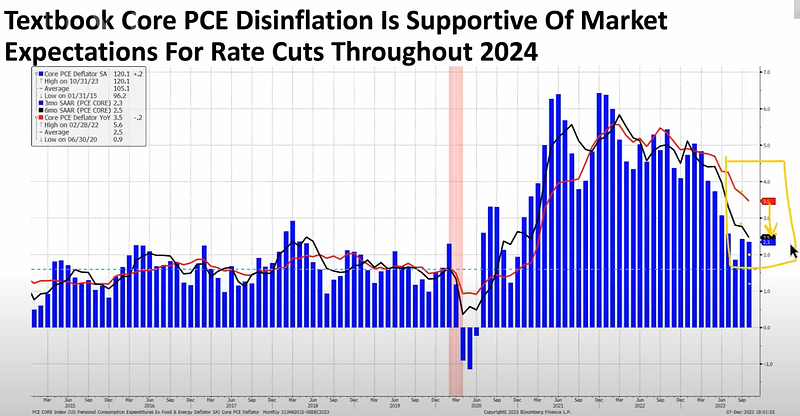

47:00 Inflation

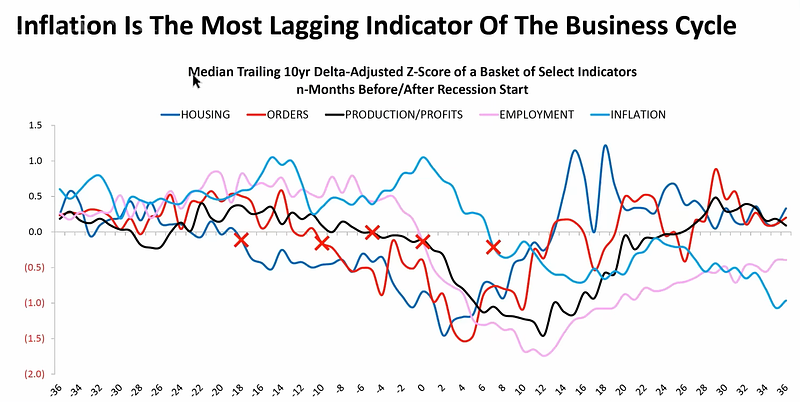

- This chart pretty much shows the HOPE framework

- Inflation cycle on a median basis tends to break down 6-8 months after a recession starts. We are experiencing "immaculate disinflation".

- Disinflation is in his opinion the likely reason for the Fed's easing.

- There are emergent signs of sticky inflation in the economy. If they evolve into more broad based signs in the economy, then it will disrupt the goldilocks scenario. But those signs are not appearing "now".

- Greenspud: Was the 3.4% y/y CPI figure reported this week (on January 11) a problem for these assumptions?

54:00 - the lag effect to watch now is the positive outcome of monetary easing.

56:00 a lot of the effect of the tightening part of the lag effect had been felt Q1:2023 when the regional banks like SVB were blowing up. We already saw the slowdown.

58:00 Adam asks Darius whether the government policy leading to asset prices rising is pernicious in the long run.

56:00 a lot of the effect of the tightening part of the lag effect had been felt Q1:2023 when the regional banks like SVB were blowing up. We already saw the slowdown.

58:00 Adam asks Darius whether the government policy leading to asset prices rising is pernicious in the long run.

- Darius says we don't need to answer that question to make money. He just cares about making and saving money in financial markets. Right now their systems say its a great time to make money in financial markets. Eventually, the systems say it won't be a great time to make money in financial markets.

- Greenspud: This is how I feel about markets. I look at the price action and make trades, hopefully profitable ones. I can't control government policy, but I can control how I manage my money to come out ahead at the end of the day. Also, I think money can be made in down markets if you are skilled at selling short.